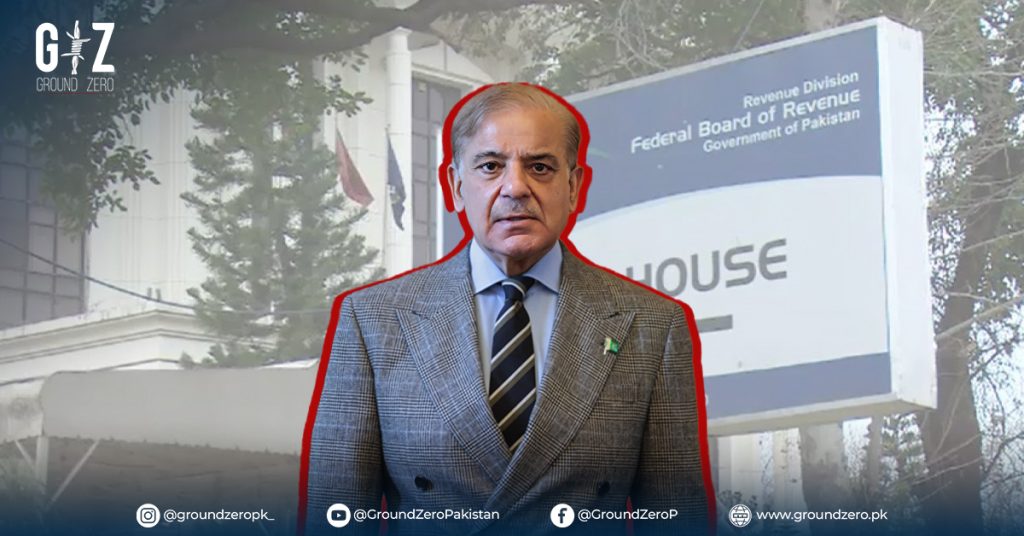

Banking Ban for Non-Filers Approved by PM Shehbaz Sharif

ISLAMABAD – In a major policy shift, Prime Minister Shehbaz Sharif has approved drastic measures to enforce tax compliance, including a ban on all banking and financial transactions for non-filers of tax returns. These measures are part of the FBR Indigenous Transformation Plan, which aims to tackle key challenges that have hindered revenue growth in Pakistan.

FBR’s Transformation Plan and Key Measures

The Federal Board of Revenue (FBR), under Chairman Rashid Mahmood Langrial, briefed the premier on the plan’s salient features. The plan is designed to reduce the amount of cash in circulation, which currently stands at 25% in Pakistan compared to 14% in Bangladesh and 7% in Malaysia. The FBR transformation plan aims to resolve structural issues and close tax loopholes.

The government will not introduce new revenue measures but will focus on implementing existing tax measures to meet the FY25 budgetary target of Rs12.970 trillion.

For more on Pakistan’s tax policies, check out Dawn’s latest coverage.

Restrictions for Non-Filers

The approved measures create three categories for tax filers. Non-filers will face strict restrictions, including bans on:

•Acquiring cars

•Purchasing immovable property

•Buying financial instruments

•Opening bank accounts (except for Asaan Accounts)

In contrast, individuals who declare an income of over Rs10 million will have full access to these benefits. Those with a lower declared income will need to explain their sources of income when making large purchases, though they can still open bank accounts.

For a detailed look at tax reforms, read World Bank’s report on Pakistan.

Crackdown on Unregistered Entities

A grim picture was painted about tax registration among manufacturers, wholesalers, and retailers. Only 14% of manufacturers are registered for sales tax, while a staggering 86% remain unregistered. The income tax registration situation is equally concerning, with only 25% of wholesalers and 8% of retailers registered.

To address this, the FBR has proposed several measures, including:

•Disallowing input on sales to unregistered entities

•Implementing digital invoicing to track sales

•Issuing notices to unregistered businesses

•Enforcing severe penalties, such as freezing bank accounts and restricting property transactions

For more insights into revenue growth strategies, check out IMF’s analysis.

Freezing Bank Accounts and Penalties

As part of the FBR’s plan, bank accounts of unregistered manufacturers, wholesalers, and distributors with an annual turnover of Rs250 million will be frozen. Additionally, properties can be attached, and a Rs1 million penalty imposed. For unregistered retailers with an annual turnover of Rs100 million, similar measures will be applied.

The plan also introduces an integrity-based incentive system for tax officers. The system will measure officers based on 60% integrity and 40% performance, with quarterly incentives awarded.

Praise for the Restructuring Strategy

Prime Minister Shehbaz Sharif praised the FBR restructuring strategy, highlighting that increased tax collection will improve public services and support social programs. He referred to the taxation system as the “backbone of the national economy” and directed the FBR to consult prominent taxpayers on the plan.

The premier also urged the FBR to expedite efforts to curb smuggling and improve customs enforcement through third-party audits.

Key Takeaways:

•Prime Minister Shehbaz Sharif has approved a banking ban for non-filers as part of a broader tax enforcement strategy.

•Non-filers will face restrictions on acquiring cars, property, and financial instruments.

•The FBR Indigenous Transformation Plan targets structural issues in Pakistan’s tax system.

•The plan includes measures like freezing bank accounts of unregistered businesses and enforcing severe penalties for non-compliance.

Stay updated with the latest economic developments on Ground Zero’s homepage.