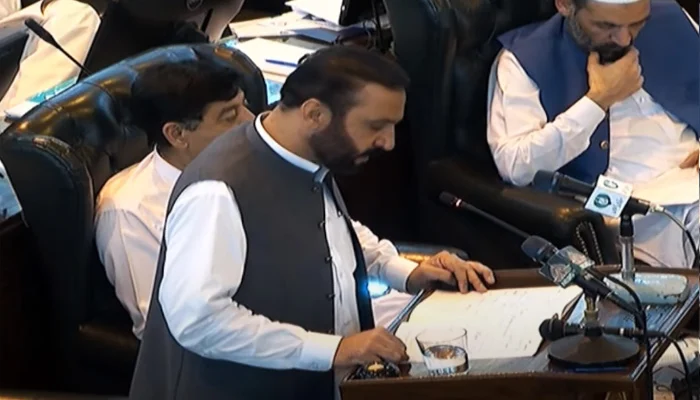

The PTI-led Khyber Pakhtunkhwa government revealed the KP Budget 2024-25 on Friday. This Rs1.7 trillion budget marks the first time a provincial government has presented its budget ahead of the federal budget, set for June 7. The KP Budget 2024-25, introduced by Finance Minister Aftab Alam Afridi, focuses heavily on social protection, law and order, and economic growth, with a development outlay of Rs416 billion.

KP Budget 2024-25 Highlights

Surplus and Expenditure

The KP Budget 2024-25 shows a surplus of Rs100bn, with expenditures pegged at Rs1.65tr. This represents a 21% increase from the Rs1.3tr spent in the current fiscal year (FY24).

Key Allocations

- Sehat Card Plus Programme: Rs28bn

- Wheat Subsidy: Rs29bn

- Youth Employment Programmes: Rs12bn, targeting 100,000 jobs through Ehsaas Rozgar, Ehsaas Youth, and Ehsaas Hunar programmes.

- Ehsaas Apna Ghar Scheme: Rs3bn for 5,000 houses.

- Chashma Right Bank Canal Project: Rs10bn to address food security in Dera Ismail Khan.

- Peshawar Bus Rapid Transit (BRT): Rs3bn subsidy.

Centre’s Reaction

The federal government criticized the KP Budget 2024-25. Minister of State for Finance Ali Pervez Malik called the early announcement “irresponsible.” He accused the PTI of jeopardizing Pakistan’s economy and urged cooperation from KP Chief Minister Ali Amin Gandapur.

Revenue and Receipts

The KP Budget 2024-25 estimates receipts at Rs1.7tr, with federal receipts contributing over Rs1.2tr. Key components include:

- Federal Tax Assignment: Rs902.5bn

- War on Terror Compensation: Rs108.4bn

- Straight Transfers: Rs42.9bn

- Windfall Levy on Oil: Rs46.3bn

- Net Hydel Profit (NHP): Rs33.1bn, with arrears at Rs78.21bn.

- Provincial Revenue: Rs93.5bn (Rs63.1bn tax, Rs30.2bn non-tax)

- Ways and Means Advance: Rs31.3bn

- Merged Districts Receipts: Rs259.9bn, including current budget allocations, ADP, AIP, and rehabilitation funds.

Expenditure Breakdown

Expenditures are detailed as follows:

- Settled Districts: Rs1.093tr

- Merged Districts: Rs144.5bn

- Provincial Salaries: Rs246bn

- MTIs Salaries: Rs26.9bn

- Tehsils’ Salaries: Rs263bn

- Pensions: Rs162.4bn

- Non-salary Expenditures: Rs264.7bn

- Capital Expenditure: Rs40.3bn

- Ways and Means Repayment: Rs31.3bn

Development Expenditure

The KP Budget 2024-25 allocates Rs416.3bn for development, including:

- Provincial ADP: Rs120bn

- Districts: Rs24bn

- Merged Districts: Rs36bn

- AIP: Rs79.2bn

- Foreign-assisted Projects: Rs130.5bn

- Federal PSDP Projects: Rs416bn

Tax Reductions and Reforms

- Sales Tax on Hotels: Reduced to 6% from 8%

- Fixed Tax on Wedding Halls

- Property Tax: Reduced to Rs10,000 per kanal from Rs13,600

- Commercial Tax on Rentals: Reduced to 10% from 16%

- Tax on Health-related Businesses: Reduced to 5% from 16%

The KP Budget 2024-25, with its significant allocations and ambitious projects, sets a new precedent for provincial fiscal planning in Pakistan.